Why not cast a vote for your wallet? Or which leaders were good for investments? | ABS-CBN

ADVERTISEMENT

Welcome, Kapamilya! We use cookies to improve your browsing experience. Continuing to use this site means you agree to our use of cookies. Tell me more!

Why not cast a vote for your wallet? Or which leaders were good for investments?

Why not cast a vote for your wallet? Or which leaders were good for investments?

Today, you may be casting a vote for your future. Or voting with your conscience. Then there are those who will vote to protect their self-interests. Why not consider a vote for your wallet?

Today, you may be casting a vote for your future. Or voting with your conscience. Then there are those who will vote to protect their self-interests. Why not consider a vote for your wallet?

Whoever wins the national elections will determine to a great extent how much money you can make in the next six years, and just as importantly if not more, the value of that money.

Whoever wins the national elections will determine to a great extent how much money you can make in the next six years, and just as importantly if not more, the value of that money.

In a recent investor presentation, WeLead CEO and financial planner Melvin Esteban provided interesting insights into stock market performance and presidential elections. According to Esteban, it’s not just the stock exchange that is impacted, but nearly all economic markers as they largely influence one another. If you’re thinking it does not matter who will win, your wallet will soon prove it otherwise.

In a recent investor presentation, WeLead CEO and financial planner Melvin Esteban provided interesting insights into stock market performance and presidential elections. According to Esteban, it’s not just the stock exchange that is impacted, but nearly all economic markers as they largely influence one another. If you’re thinking it does not matter who will win, your wallet will soon prove it otherwise.

“The new president will greatly impact our everyday lives and our financial portfolios, from inflation rates that will determine our spending power, to returns on our short-term, medium-term and even long-term investments,” explained Esteban. If you are looking for more reasons to determine the names to shade in your ballot, consider Esteban’s market views, drawn from Datasteam’s information.

“The new president will greatly impact our everyday lives and our financial portfolios, from inflation rates that will determine our spending power, to returns on our short-term, medium-term and even long-term investments,” explained Esteban. If you are looking for more reasons to determine the names to shade in your ballot, consider Esteban’s market views, drawn from Datasteam’s information.

ADVERTISEMENT

#1 Is it timing, or time in the stock market?

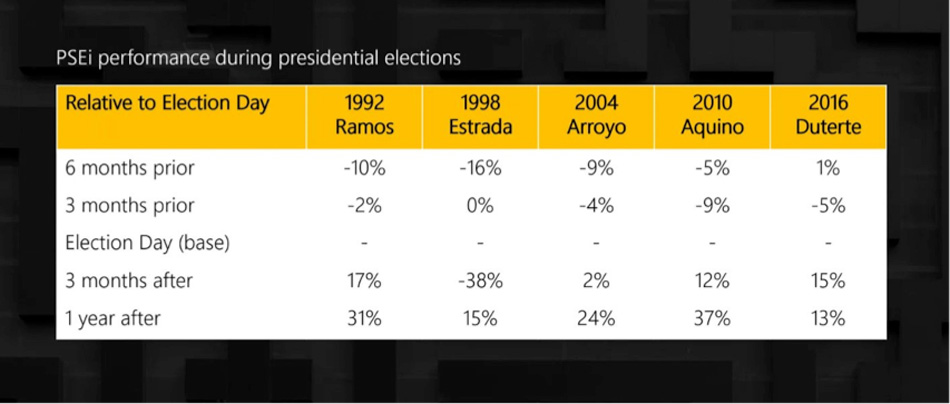

Esteban looked back at the stock exchange performance around the election period and first year in office of the last four presidents and the incumbent. Data showed that if you took election day as Day Zero, for all of the five presidents, the stock market grew by double digits after a year. The most impressive growth came during President Benigno Aquino III’s first year in office with 37%, followed by President Fidel Ramos with 31%. The lowest return came from President Joseph Estrada’s administration at 15%.

Esteban looked back at the stock exchange performance around the election period and first year in office of the last four presidents and the incumbent. Data showed that if you took election day as Day Zero, for all of the five presidents, the stock market grew by double digits after a year. The most impressive growth came during President Benigno Aquino III’s first year in office with 37%, followed by President Fidel Ramos with 31%. The lowest return came from President Joseph Estrada’s administration at 15%.

“Financial planners would always caution investors that it is impossible to time the market, and it’s the amount of time you are invested that counts. But historical data showed that election day is a good time to invest in the stock market, and cash in a year later,” said Esteban.

“Financial planners would always caution investors that it is impossible to time the market, and it’s the amount of time you are invested that counts. But historical data showed that election day is a good time to invest in the stock market, and cash in a year later,” said Esteban.

He described the first 365 days as a “honeymoon period” that newly-elected presidents enjoy, which can even last up to two years. After the “honeymoon period,” investors and the public at large begin to look for whether the elected presidents delivered on their “promises”, and that’s when the stock market performance becomes harder to predict.

He described the first 365 days as a “honeymoon period” that newly-elected presidents enjoy, which can even last up to two years. After the “honeymoon period,” investors and the public at large begin to look for whether the elected presidents delivered on their “promises”, and that’s when the stock market performance becomes harder to predict.

If only I could get my hands on a time machine, I would go back to 1992 and 2010. But seeing that’s impossible, let’s stick to what we can possibly have. In choosing your president, consider the data and look for one with the track record and qualities of the “best-performing” presidents.

If only I could get my hands on a time machine, I would go back to 1992 and 2010. But seeing that’s impossible, let’s stick to what we can possibly have. In choosing your president, consider the data and look for one with the track record and qualities of the “best-performing” presidents.

#2 Approval ratings do not translate to better returns

President Rodrigo Duterte is the only president in our history to have retained positive popularity ratings during his entire term. However, data showed that on his induction and even now as he prepares to step down, the stock market was and is bullish. Some attribute this to the pandemic, but let’s consider that this is a global crisis, and yet some international markets are doing better.

President Rodrigo Duterte is the only president in our history to have retained positive popularity ratings during his entire term. However, data showed that on his induction and even now as he prepares to step down, the stock market was and is bullish. Some attribute this to the pandemic, but let’s consider that this is a global crisis, and yet some international markets are doing better.

ADVERTISEMENT

“With nearly all past presidents, there was a crisis that impacted the economic markets. And yet this did not cripple the stock market. Of the 5, we saw the best performance from President Aquino, followed by President Gloria Arroyo who interestingly had the worst approval rating of them all,” related Esteban.

“With nearly all past presidents, there was a crisis that impacted the economic markets. And yet this did not cripple the stock market. Of the 5, we saw the best performance from President Aquino, followed by President Gloria Arroyo who interestingly had the worst approval rating of them all,” related Esteban.

Based on WeLead’s analysis of market performance from 1987 to 2021, with the white graph tracking the approval rating and the black graph tracking the stock market, the latter does not always listen to the former.

Based on WeLead’s analysis of market performance from 1987 to 2021, with the white graph tracking the approval rating and the black graph tracking the stock market, the latter does not always listen to the former.

#3 For whom will peso appreciate or depreciate?

There are many factors that determine foreign exchange movements, but Esteban assigns the most weight to foreign portfolio money. “Many assume that remittances from overseas Filipino workers drive the value of the peso. Yes, it helps, but the one that really moves the needle is foreign hot money. This is because when they come in, they come in at huge volume and at a very short window. To attract this, you need a sitting president with a clear economic stand and a credible economic team to sustain foreign investors’ appetite,” Esteban clarified.

There are many factors that determine foreign exchange movements, but Esteban assigns the most weight to foreign portfolio money. “Many assume that remittances from overseas Filipino workers drive the value of the peso. Yes, it helps, but the one that really moves the needle is foreign hot money. This is because when they come in, they come in at huge volume and at a very short window. To attract this, you need a sitting president with a clear economic stand and a credible economic team to sustain foreign investors’ appetite,” Esteban clarified.

That’s why it’s important for candidates to spell out, in as much detail as possible, their economic platform and who or how they will appoint members of their economic team. Silence makes investors uneasy, and the hot money to likely fly away and exit the country. And when it does, market activity will slow down and that will translate to less growth and poorer prospects for local investors.

That’s why it’s important for candidates to spell out, in as much detail as possible, their economic platform and who or how they will appoint members of their economic team. Silence makes investors uneasy, and the hot money to likely fly away and exit the country. And when it does, market activity will slow down and that will translate to less growth and poorer prospects for local investors.

* * *

* * *

ADVERTISEMENT

We all want progress. But that comes in many forms. To some, it’s better quality of life for their family. To others, they want to drive change for communities, regions, even the country as a whole. Whoever wins the election, let’s hope she or he will deliver progress in one or all forms.

We all want progress. But that comes in many forms. To some, it’s better quality of life for their family. To others, they want to drive change for communities, regions, even the country as a whole. Whoever wins the election, let’s hope she or he will deliver progress in one or all forms.

RELATED VIDEO

Read More:

Halalan 2022

investments

economy

foreign exchange

stock market

Aneth Ng Lim

Paying It Forward

featured blog

blogroll

ADVERTISEMENT

ADVERTISEMENT